In January, LME nickel prices reach their highest point since September 2019 — driven by supply disruptions, strong stainless steel production and a looming shortage of 'battery suitable'nickel.

This week, the government in New Caledonia collapsed. The French territory in the Pacific is the world’s fourth-biggest producer of mined nickel, behind Indonesia, Philippines and Russia.

It accounts for about 9 per cent of global output.

Early in January the Philippines — the biggest supplier of nickel ores to global #1 consumer China — halted mining on an island home to a number of projects.

Supply looks moderately shaky, in other words. Meanwhile demand is going gangbusters, particularly in the battery space.

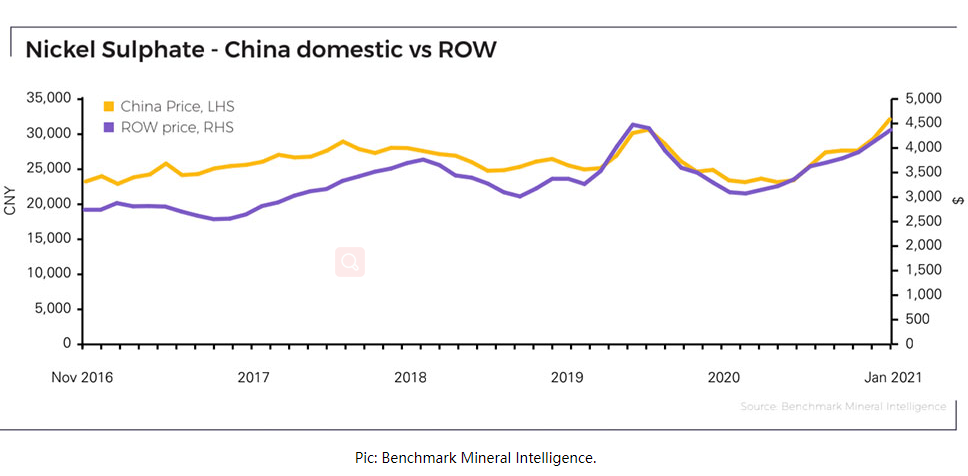

In January, Chinese nickel sulphate prices and mixed hydroxide precipitate (MHP) payables increased by 9.4 per cent and 2.4 per cent, respectively.

Sulphate is a ~22 per cent nickel product used in lithium-ion batteries. MHP comes from nickel laterite ore and typically contains ~37 per cent nickel.

The rising demand environment has been confirmed by key market players, Benchmark Mineral Intelligence says.

China’s GEM – the world’s biggest battery precursor producer – revealed late January that its nickel-based precursor production was operating at full capacity.

With its order book for the whole year filled, the company is planning to increase precursor production capacity by year end to meet surging demand.

GEM also signed a memorandum of understanding (MoU) to double its equity from 36 to 72 per cent in the PT QMB New Energy Materials nickel and cobalt project in Indonesia.

“GEM cited its intention to expand ‘strategic control’ over nickel resources as the rationale behind the decision, as the company moves to manage raw material price and supply risk as it scales its high-nickel precursor and cathode production capabilities, amid expectations of a looming shortage of battery suitable nickel supply,” Benchmark says.

Elsewhere, Chinese lithium major, Ganfeng Lithium (Ganfeng), agreed to a 10-year offtake deal to buy laterite nickel ore from Indonesian nickel ore producer, Silkroad nickel.

“More widely, the deals outlined above highlight rising concerns of nickel supply for the battery industry in the medium term, and the increasing commitments the supply chain is willing to make to lock in supply,” Benchmark says.

*Subscribe to our daily newsletter

*Join our small cap Facebook group