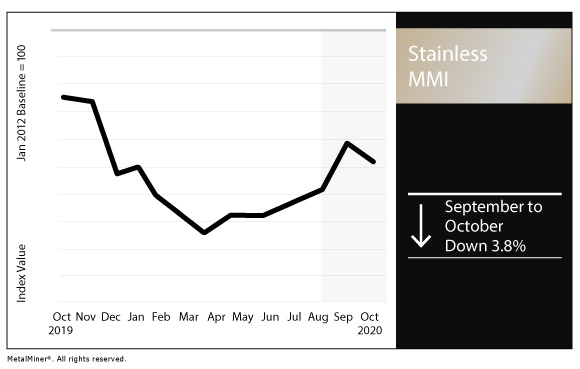

The Stainless Monthly Metals Index (MMI) decreased by 3.8% for this month’s index value, as U.S. stainless imports surged last month.

U.S. stainless imports rise 76%

The U.S. Department of Commerce reported the U.S. imported a total of 91,600 metric tons of all stainless products during September.

The September total marked a 76% year-over-year increase. In addition, the September total marked a 42% increase from the 2019 average of 64,600 metric tons.

The higher-than-usual import total is in line with the unexpected demand increase in major appliances, which use stainless steel sheets.

The U.S. market has a shortage in most appliances. This is due to customers storing larger amounts of food, plus shutdowns or personnel reduction manufacturers undertook for a few months. Additionally, manufacturers did not ramp up production to full capacity due to economic uncertainty.

These circumstances created a production backlog that might last well into 2021 and kickstart demand for stainless steel.

However, not all stainless products have recovered.

Outokumpu announced its intention to scale down its long products business, which includes wire rod, wire, bar, rebar and semi-finished long products.

The decision comes after the business made small net sales and negative adjusted EBITDAs. The scaledown measures include: personnel reduction, increasing operational efficiency and focusing on higher-value specialty grades.

Nickel usage trends

Currently, the stainless steel market consumes 66% of the nickel market.

However, the electric vehicle industry may disrupt this trend by 2030.

On Battery Day, Tesla announced its goal of reaching 100 GWh by 2022 and 3 TWh per year by 2030.

Stockhead, a news publication focused on ASX-listed small and micro cap, with the help of Wood Mackenzie and Benchmark Mineral Intelligence, estimated Tesla would need 1.15 million metric tons of nickel a year — or 50% of the current global supply — to achieve its goal.

As such, the goal is unlikely to be achieved, even if supply increases to 4.3 million metric tons as expected. Tesla will have to compete for nickel supply with other nickel-based battery producers and the stainless steel sector.

Nevertheless, Tesla’s announcement supports the bullish outlook for nickel demand and might incentivize the investment in nickel exploration and development.

Actual metals prices and trends

The Allegheny Ludlum 316 stainless surcharge increased 10.7% month over month to $0.93/pound. The 304 surcharge rose 9.2% to $0.71/pound.

LME primary three-month nickel declined 6.0% to $14,512/mt.

Chinese 316 cold-rolled coil declined to $3,103.90/mt, while Chinese 304 cold-rolled coil rose to $2,302.18/mt.

Chinese primary nickel declined 5.7% to $16,755.15/mt. Indian primary nickel dropped 8.0% to $14.37/kilogram.

FeCr lumps increased 0.8% to $1,529.88/mt.

See why technical analysis is a superior forecasting methodology over fundamental analysis and why it matters for your stainless buy.